Macrs depreciation spreadsheet

This paper develops an Excel model useful to students academics and business professionals - that values the impact of government driven increases in temporary first-year. As an alternative to the executable tool you can download the spreadsheet here.

Free Macrs Depreciation Calculator For Excel

MACRS Depreciation and Capital Budgeting Analysis.

. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. Under the MACRS the depreciation for a specific year j D j can be calculated using the following formula where C is the depreciation basis cost and d j is the depreciation rate. Sensitivity Analysis You and your spouse have recently inherited money from a distant relative.

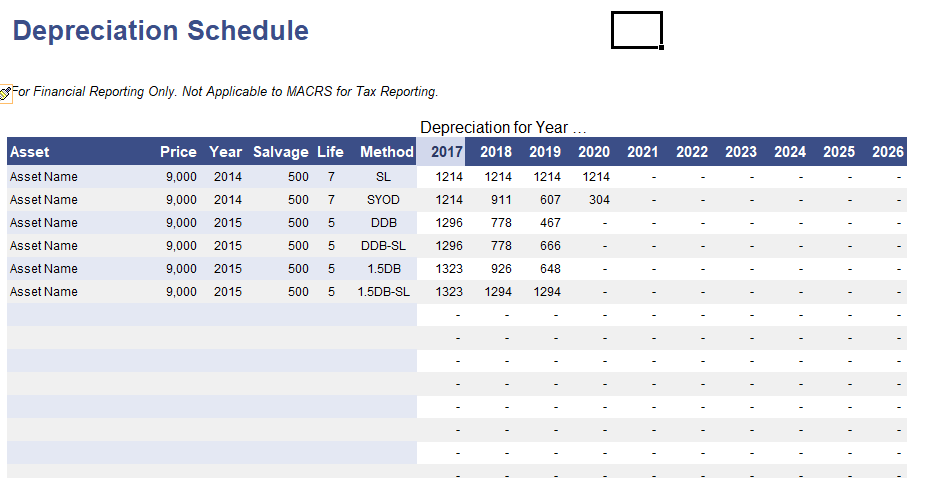

Fixed asset record with depreciation Keep track of your equipment and other fixed assets with this accessible spreadsheet template. Calculates tax depreciation schedules for depreciable items. Answer to MACRS Depreciation and Capital Budgeting Analysis.

The result should be 2449. While Excel and Quatlro Pro do not have a function MACRS cost class life year they do have a variable declining balance function VDB that can be used to compute. Then copy this VDBB1B2B3B4B5 into B6 without the quotation marks.

Instead the 5-year recovery period and a salvage value of 0 are. Download this FAST Tool. The calculator makes this calculation of course Asset Being Depreciated -.

C is the original purchase price or basis of an asset. MACRS Depreciation and Capital Budgeting Analysis. D i C R i.

Paste this table into an empty spreadsheet in location A1. Sensitivity Analysis You and your spouse have recently inherited money from a distant relative and are. 179 expense macrs depreciation 2015 total 2015 2016 2017 accumulated depreciation 2500000 28580 27000.

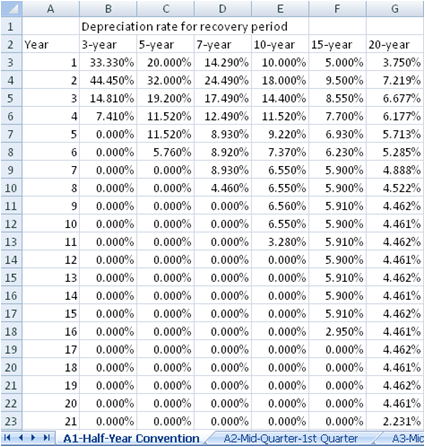

The MACRS Depreciation Calculator uses the following basic formula. Refer to the table on the right to calculate the macrs depreciation a. MACRS Methods Factors No Switch NA Years Asset Description Residential Property MACRS HY Convention - 200DB150DB 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Name.

The units-of-production method of depreciation does not have a built-in Excel function but is included here because it is a widely used method of depreciation and can be. R i is the. Notice that the variable values for the workstations life and salvage value are not used in the VDB to find the MACRS values.

Where D i is the depreciation in year i. Record the asset details including serial number physical. While Excel and Quatlro Pro do not have a function MACRS cost class life year they do have a variable declining balance function VDB that can be used to compute.

Implementing Macrs Depreciation In Excel Youtube

9 Free Depreciation Schedule Templates In Ms Word And Ms Excel

Depreciation Macrs Youtube

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Excel Finance Class 85 Macrs Depreciation Asset Sale Impacts On Npv Cash Flows Youtube

How To Calculate Macrs Depreciation When Why

Macrs Property Depreciation Template Visual Paradigm Tabular

Double Teaming In Excel

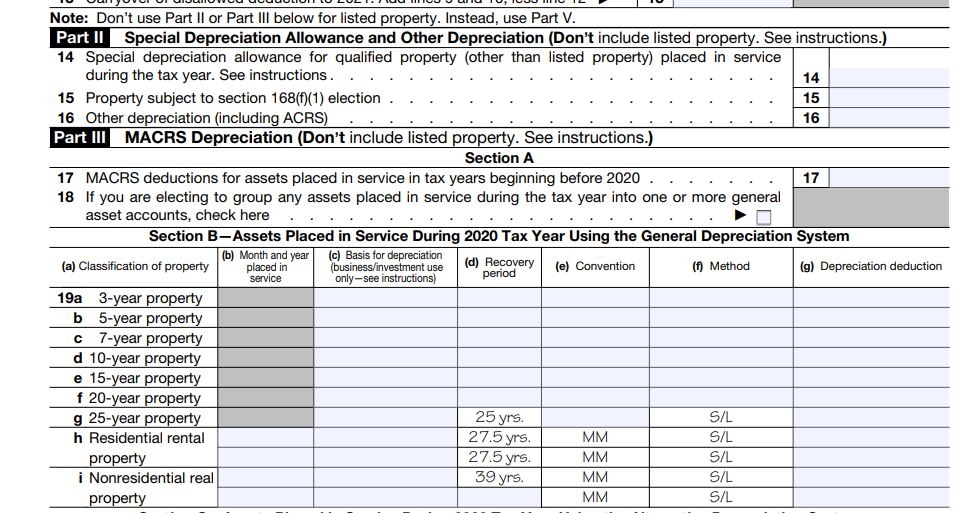

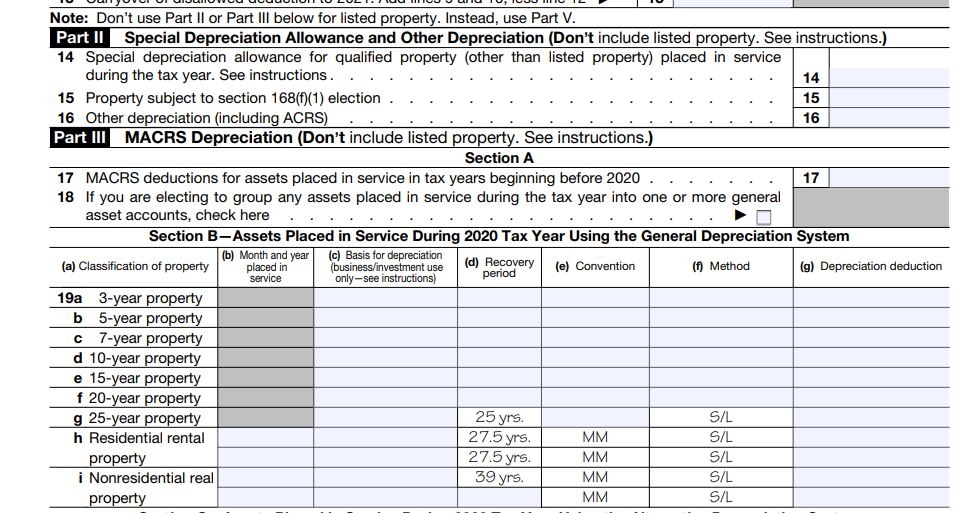

2020 Form 4562 Depreciation And Amortization 21 Nina S Soap

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Macrs Depreciation Table Excel Excel Basic Templates

Depreciation Calculator Excel Template For Free Download

Macrs Depreciation Calculator With Formula Nerd Counter

Double Teaming In Excel

Guide To The Macrs Depreciation Method Chamber Of Commerce

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Straight Line Double Declining